Systematic Investment Plans or SIPs have been touted as one of the simplest and most irresistible ways to accumulate wealth. Experts support the view that ₹2,000 a month, albeit small, will grow to a corpus worth an astronomical ₹7.6 lakh-all thanks to the compounding effect. This makes SIP doubly attractive to budding investors and people engaged in long-term wealth-building plans.

Understanding Compounding in SIP

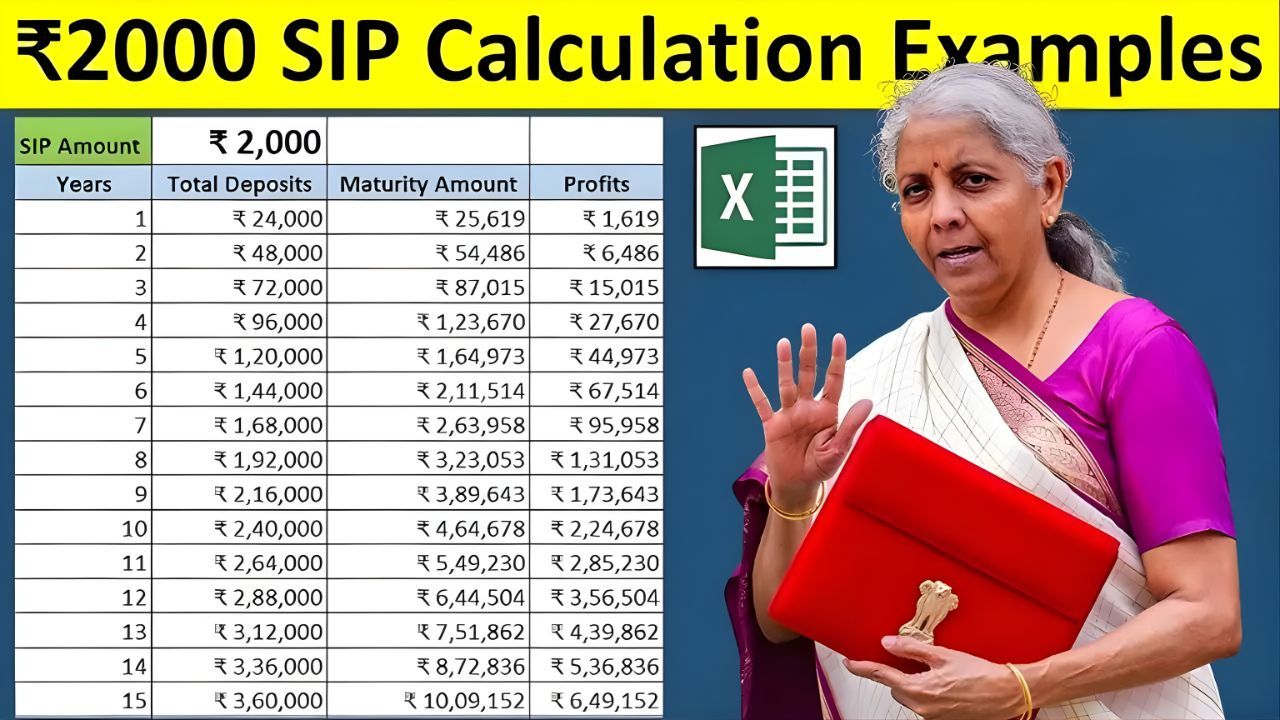

Compounding is when the return earned on an investment is reinvested in itself. Under the SIP methodology, the monthly contributions grow as a function of both the invested capital and the earned return, which also earn a return in gradual increments. This exponential growth then has the potential to turn even very small monthly contributions into a very big corpus over multiple years.

Case in Point: Conversion ₹2,000 Into ₹7.6 Lakh

If an individual invests through a systematic investment plan (SIP) in any mutual fund, earning an average annual return of 12%, then, in 10 years, he/she will acquire around ₹7.6 lakhs. The growth is slow, but in the latter part of investment, it is the power of compounding that multiplies the value.

Why Starting Early Matters

Time is the key in gaining the maximum benefit of compounding. A small step that was taken some time back will benefit vested investors – due to the long-term investment horizon, the accumulated earnings begin earning earnings. Even if investment is delayed by a few years, the total corpus at the end of the period would be significantly reduced.

SIPs for Retail Investors

SIPs make one practice discipline in investing. They minimize market risk through rupee-cost averaging. SIPs are an affordable investment for people with smaller savings capacity. It is flexible to increase, pause, or end SIP based on the financial standing of an investor.

Choosing the Right Mutual Fund

Equity-oriented funds potentially offer the best returns over the long run, while debt and hybrid funds assure decent capital appreciation with lesser risk factors.

Things to Think About

SIPs may be wonderful but their returns may be unpredictable, full of market occurrences, and certainly not guaranteed. It is crucial for investors to keep calm, refrain from panic selling, focus on their medium or long term goals, and keep a constant track of their schemes’ performances.

Getting Started: Your First SIP in 2021

For parties starting their SIP, the purchase process is simple enough. All you have to do is open an account with the concerned Mutual Fund or through a brokerage, fill in the KYC formalities, and the desired amount will be debited automatically off of your account on a monthly basis. Modern apps and platforms offer reminders, performance tracking, and flexible investment options

Conclusion

Systematically investing just ₹2,000 monthly in comparison to speculating in the stock market can satisfy dreams of owning a ₹7.6 lakh property ten years hence if the trainings covered over the years can be converted into long-termed consumables. Buying long-term investment plans [sic] is quite interesting and fun to observe because small and regular SIPs are the ways and means of actualization of the said plan for long-term real estate planning.