Indian Post Office Fixed Deposits happen to be one of the safest investment avenues in the country, as these initiatives are government-endorsed and secured. In 2026, with interest rates never remaining constant for long, investors are confused: they need to know for certain how much they are going to receive at maturity. When using a Post Office FD calculator, the investor can find out almost immediately what his payoff amount will be without the trouble of doing so manually.

What Is a Post Office FD Calculator?

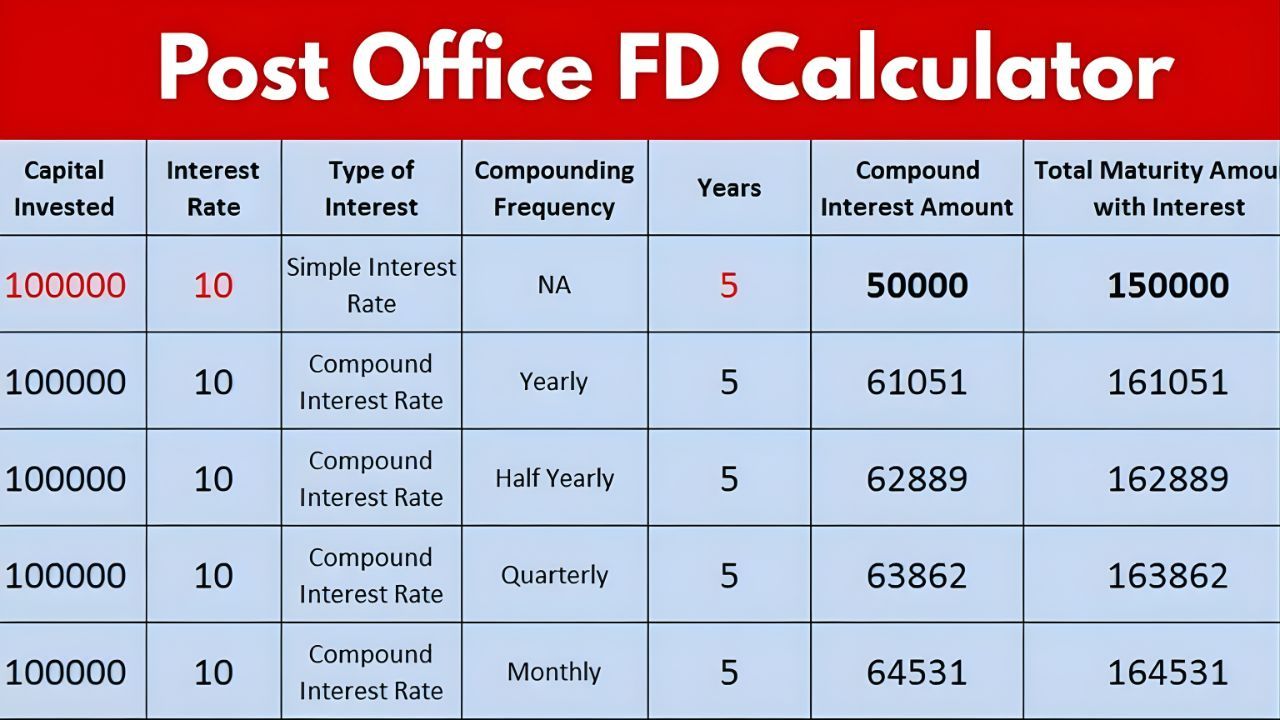

A Post Office FD calculator is a simple method of calculating the amount that will be deposited in your Fixed Deposit based on three parameters: the principal, the term, and the rate of interest. This calculates the compound interest on the investment sum, based on the rules of post office time deposits, rendering the precise sum to maturity in an instant.

Mobile deposit rates are applied for 2026 on Post Office Fixed Deposits

Percentage of Interest on Fixed Deposit in Post Office is determined by the tenure chosen. This remains constant during the term of deposit. On the other hand, the interest is paid once a year and compounded quarterly. It ultimately ends up giving a higher return than the savings account in the Post Office.

How Does the Post Office F D Calculator Work?

In this method, the interest is applied on the deposit amount after every time-in two quarters-as decided by the chosen installment till it accumulates the interest, giving the other amount depending on whether the next year began halfway down. A table displays the amount of the same total amount and some other details of it.

Calculation of Maturity amounts by Post Office FD Calculator

- Principle Tenure Interest Rate % Maturity Amount (Approx.)

- ₹1,00,000 1 Year 6.9% ₹1,06,900

- ₹2,00,000 2 Years 7.0% ₹2,30,000 (approx.)

- ₹5,00,000 3 Years 7.1% ₹6,15,000 (approx.)

- ₹5,00,000 5 Years 7.5% ₹7,25,000 (approx.)

There are different values which are indicative and may vary slightly depending on the exact interest rate at the time of investment. The calculator will be useful for salaried individuals, retirees, senior citizens, and anyone looking for safe and predictable returns. People who like to see the big picture of investment planning and check different tenures before investing will find it very useful. Tax rules related to post office FD:

Interest earned on the Post Office FD is taxable as per the investor’s income tax slab. Yet, the advantage of this FD lies in the 5 year FD, where taxpayers purchasing the FD can claim tax deduction under Section 80C. So, one can call it a guaranteed return tax-saving product.

Benefits of Using a Calculator Before Investing:

Utilization of Post Office FD calculator helps to safeguard an impressive level of fundamentalism while ensuring expenses, thus allowing the investors to lay down precise lines of objective for themselves, for example, a college education, wedding, or retirement. Also, it lets one compare FD rates across a range of saving options, which may range from bank FDs to the small savings drop.

Final Evaluation

For every investor seeking to carve a safer course of action on investments, this Post Office FD Calculator 2026 stands out as a worthy navigation tool. One is in a better position to put in an investment confidently when the exact figure for the age of the maturity is known beforehand. The Post Office FDs are bound to literal inconsistency and exaggerated security with zero if we talk about the credible return on them.